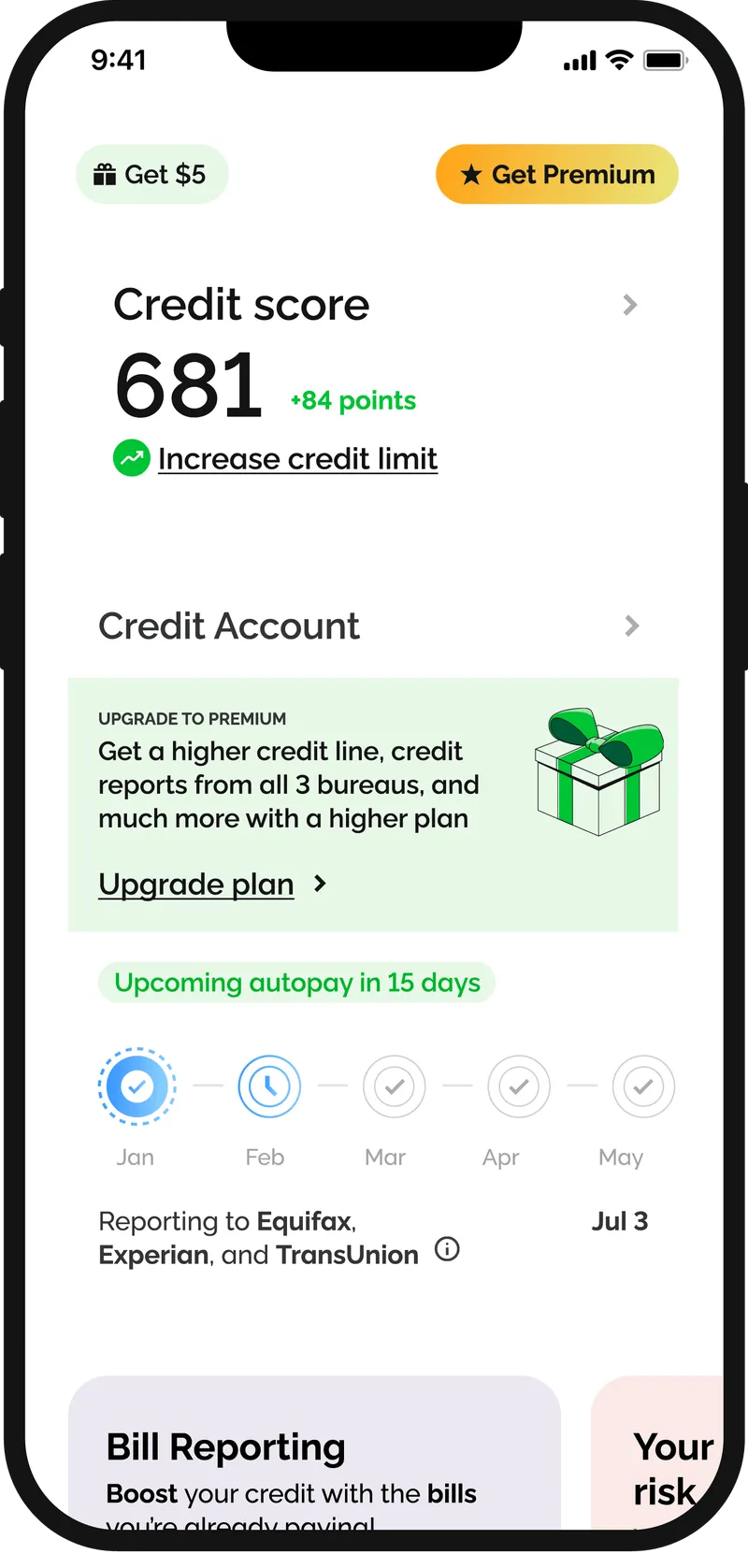

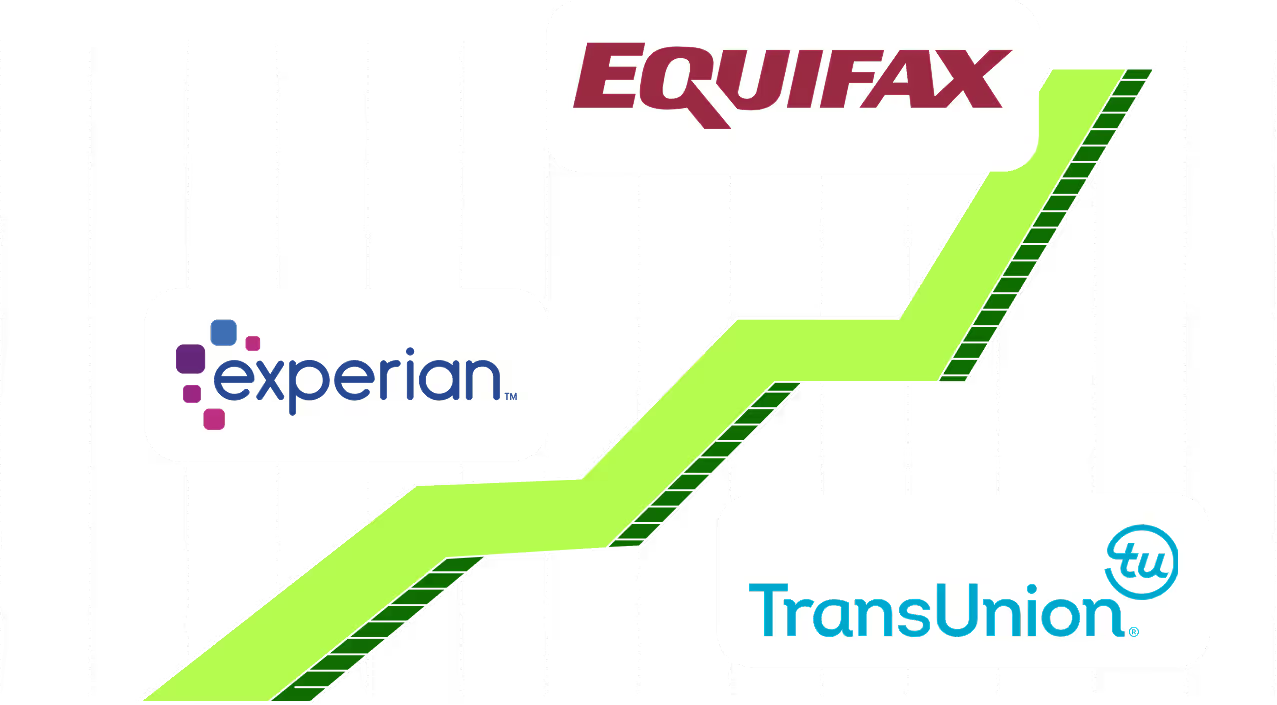

Credit-building & financial tools, made easy.

on avg for users with starting credit under 600 in a year with on time payments

on avg for users with starting credit under 600 in a year with on time payments

Since 2019, we've helped millions of people just like you take control of their financial future.

On avg for users with starting credit under 600 in a year with on time payments